Since the beginning of 2023, Ukrainian banks have doubled their required reserves and almost 6 times since the beginning of the war — National Bank

[ad_1]

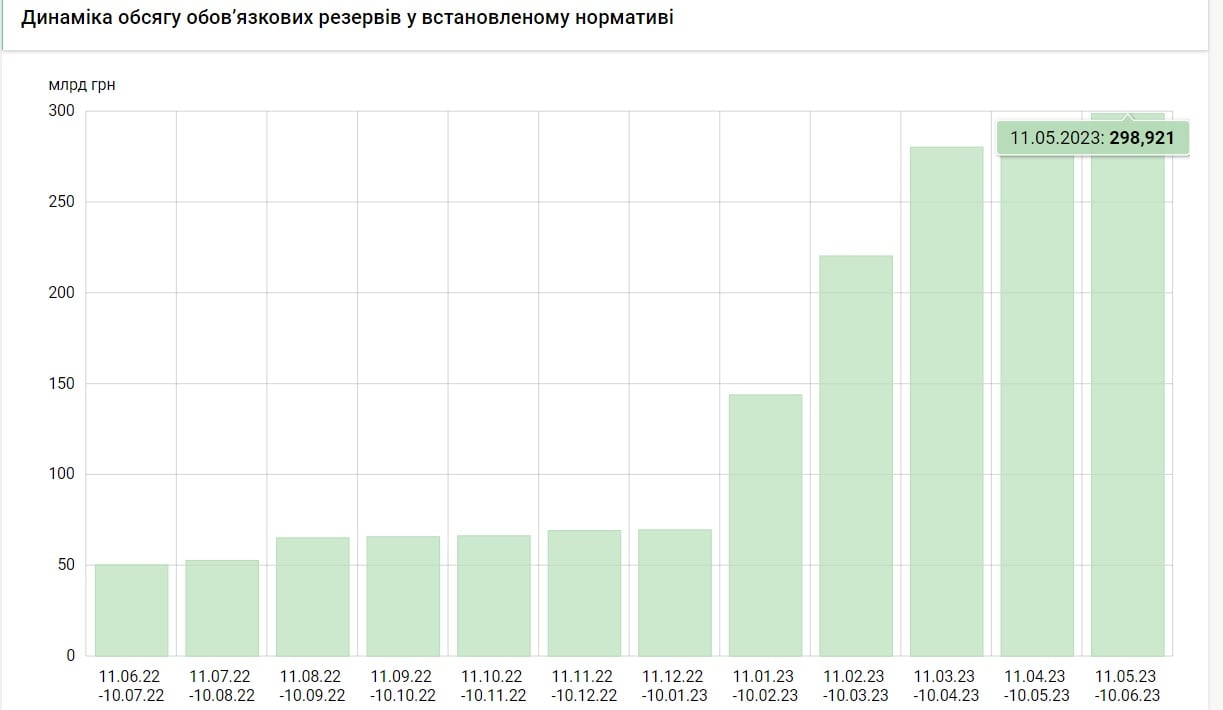

After the entry into force of the National Bank’s new requirements for the formation of mandatory reserves (OR) for the deposits of natural persons from May 11, 2023, their total volume increased by 8% to UAH 298.9 billion. And since the beginning of 2023 (January 11), it has increased by 2.1 times. This is reported on the new page of the National Bank “Obyazatelnye rezervy”, which was recently presented by the NBU.

Photo: bank.gov.ua 0

►Read “Ministry of Finance” on Instagram: the main news about investments and finances

The regulator reported an increase in the amount of required reserves of the banking system for a month (from April 11 to May 11) from UAH 276.9 billion to UAH 298.9 billion. The official dynamics of the OP is as follows:

- January 11, 2023 — UAH 144.1 billion;

- February 11, 2023 — UAH 220.6 billion;

- March 11, 2023 — UAH 280.5 billion;

- April 11, 2023 — UAH 276.9 billion;

- May 11, 2023 — UAH 298.9 billion.

This happened due to tightening of reserve requirements by the National Bank, first of all, for deposits of individuals attracted for a period of less than 3 months (up to 93 days). Officials took this step in order to motivate banks to more actively collect medium-term and long-term deposits from the population, and attract less funds to current accounts.

All this is needed by the NBU in order to tie up the excess hryvnia money supply, which has grown significantly due to the emission of the NBU in 2022 — by UAH 400 billion, and to contain the growth of inflation. What the management of the regulator has repeatedly stated.

To this end, since the beginning of 2023, the National Bank has already revised its requirements for the formation of mandatory reserves by banks four times, and at the moment they reach 30% for foreign currency funds of individuals in current accounts and 20% for hryvnias.

Read also: The National Bank named the most profitable banks since the beginning of the year

The NBU has published statistics on the revision of the reserve requirement since 2004, from which it can be seen that over the past 19 years it has changed the reserve requirements on average 2-3 times per hour, and it did this only once out of four times — in 2006. True, then it was about reducing reserve requirements from 8% to 1−5% (hryvnia/foreign currency).

At the beginning of the Great War (as of March 11, 2022), the total amount of mandatory reserves of our banking system was only UAH 52.7 billion, which is 5.7 times less than now.

Conference “Invest Talk Summit” Find out how to make money on investments in 2023-2024! Details on the website.

Promo code for a 10% discount: minfin10.

🕵️ We created a small survey to learn more about our readers.

💛💙 Your answers will help us become better, pay more attention to topics that are interesting to you. 🤗 We will be grateful if you find a minute to answer our questions.

Author:  Elena Lysenko is a financial journalist

Elena Lysenko is a financial journalist

Source: Ministry of Finance

Views: 18

[ad_2]

Original Source Link