Some FOPs will be transferred from 2% to the general system. Who will it affect?

[ad_1]

Some FOPs of the third group may face a situation when they will be transferred to the general taxation system after the abolition of the personal 2% regime introduced at the beginning of martial law. Tax consultant Oleksandr Zaraiskyi told about this, reports AIN.

Photo: lv.tax.gov.ua 0

► Read the “Ministry of Finance” page on Facebook: главные финансовые новости

Who does it concern?

The problem concerns FOP group 3, which became a 2% taxpayer from the first day of its state registration. That is, people who registered as FOP 3 groups with a rate of 5% in 2022 and immediately switched to a rate of 2%.

Many of these FLPs may not even know that they are tax payers of 2% from day one. After all, when submitting an application for registration of an LLC, for example, through “Deystvie”, they first chose 5%, and only then submitted an application in the taxpayer’s electronic office for a transition to 2%. So it seems that after the cancellation of the special regime, they should be transferred to 5%.

But it can’t be wrong. The fact is that in many cases, the tax authority registered such FOPs as payers of the 2% tax not from the day of filing the corresponding application, but from the first day of their state registration.

This applies to FPOs that submitted an application for a 2% transition before the expiration of 10 days from the moment of state registration. So, after the cancellation of the special regime, such entrepreneurs will not be transferred to the 5% rate, but to the general taxation system.

How to check FOP

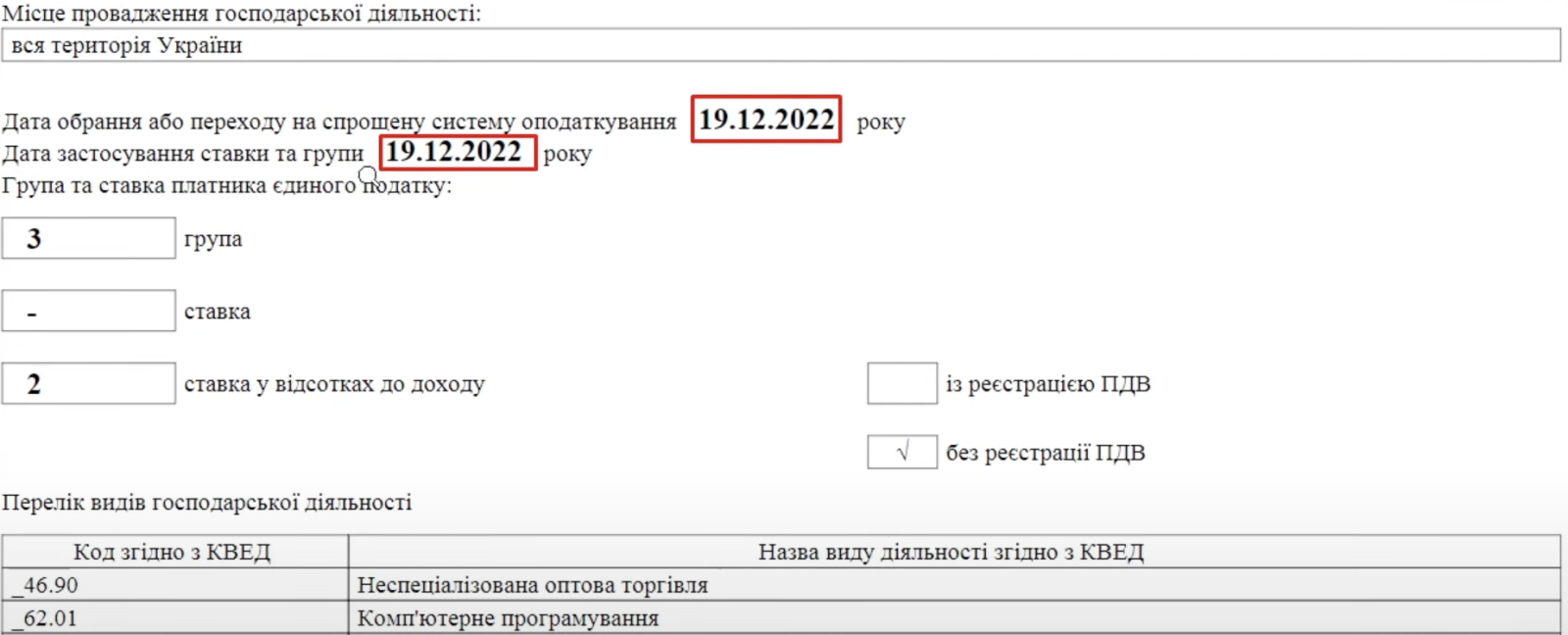

It is necessary to order a single tax statement in the electronic account of the payer on the website of the State Tax Service. If in the statement the date of transition to the simplified taxation system and the date of application of the 2% rate coincide, as in the screenshot below, then the FOP is a payer at the 2% rate from the first day of state registration.

In this case, after the abolition of the special group in 2%, the FLP will automatically be on the general taxation system (18% personal income tax + 1.5% military levy + 22% ESR).

Read also: The number of FLPs in the IT sphere increased by almost 32,000 during the war — DOU study

What works

It is necessary to switch to the 5% rate in advance. To do this, you need to submit an application for the transition from July 1 (the date from which the 2% will probably be canceled) from the special regime to the 5% rate until June 15, 2023. In this case, the tax authority will transfer the FLP by 5%, and there will be no automatic transfer to the general system.

All other FOPs may not worry – after the cancellation of the special regime, they will be automatically transferred to the taxation system and rates that were used before the transition to 2%.

Source: Ministry of Finance

Views: 11

[ad_2]

Original Source Link