Fighting Inflation: How Central Banks Counter Rising Prices

[ad_1]

Mlarge-scale economic stimulus programs during the corona crisis became one of the reasons for the record price surge in the world.

This forced most central banks (CBs) to quickly strengthen monetary policies and use half-forgotten and sometimes unconventional instruments in the conditions of the formed liquidity surplus.

Surplus liquidity

The record acceleration of global inflation and the imbalance of inflationary expectations in 2022 prompted the Central Bank to move to a tightening of monetary policy to ensure price stability. At the same time, the central banks of many countries faced a sluggish reaction of market rates to the increase of key rates – a side effect of the liquidity surplus, which was formed due to large-scale economic stimulus programs during the corona crisis.

In order to increase the impact on inflation, the leading central banks began to switch to so-called quantitative easing. Thus, the US Federal Reserve rolled back the quantitative easing program and started reducing the balance sheet.

In order to curtail the targeted long-term refinancing program, the European Central Bank (ECB) revised its terms in October and announced the linking of the rate for such operations to the key rate, which means its actual increase from 0.75% to 3.5%. ECB also announced about reduction of own portfolio of securities from March 2023 by an average of 15 billion euros per month.

The problem of limited monetary transmission due to excess liquidity has become especially acute in countries with developing markets. Due to lower confidence in national currencies and traditionally less anchored inflationary expectations, the threat of dollarization of economies in many countries has increased significantly.

As well as the risks of increased devaluation pressure and further acceleration of already high inflation. Therefore, central banks of developing countries focused on combating the risks generated by excess liquidity in order to strengthen their ability to control exchange rate and inflationary processes.

The new is the well-forgotten old

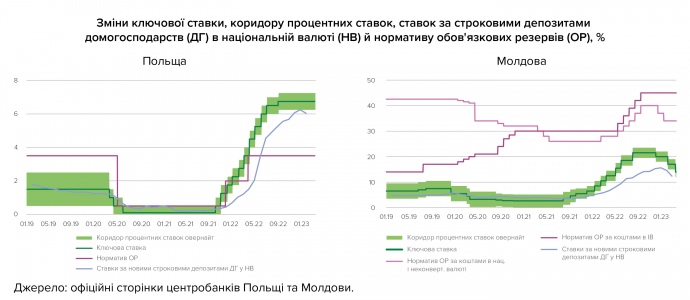

In 2022, the Central Banks of Poland, Moldova, Egypt, India and Ghana actively used one of the traditional and oldest tools of monetary policy to normalize the liquidity of banks – increasing required reserves (OR).

Until recently, this tool was mostly used to achieve macroprudential goalsincluding – decrease in the level of dollarization of the economy. However, in 2022, the Central Bank, in particular of Poland and Moldovaclearly articulated that they use it to strengthen monetary conditions.

The Central Bank of Poland raised the key rate by 500 bp. p. (up to 6.75%), and in addition – the OR standard, initially from 0.5% to 2%, and later – to 3.5%. An increase in the standard made it possible to withdraw about 19% of the total volume of liquidity.

As a result, the monetary transmission tightened: in response to a decisive increase in the key rate interest rates on deposits rose sharply. This led to the transfer of some funds from current accounts to time deposits and revived interest in government securities.

In 2022, Moldova faced extreme inflationary pressure (in October, price growth was 34.6% year-on-year). The Central Bank of Moldova raised the key rate from 2.65% to 21.5%. However, the monetary transmission was sluggish: in the summer, with inflation at around 30% and the key rate at 18.5%, the average interest rates on deposits remained at the level of around 8.5%.

In addition to raising the key rate to stimulate savings in the national currency The Central Bank strengthened the standards of the OP. From mid-2022, they have increased from 26% to 40% based on funds in national currency and from 30% to 45% based on funds in freely convertible currency.

IN as a result in the third quarter, the weighted average rate on time deposits in the national currency for individuals increased to 13.1% (by 9.5 percentage points more than a year earlier), and the volume of new time deposits increased from 6.9% to 66, 2%.

Complex solutions

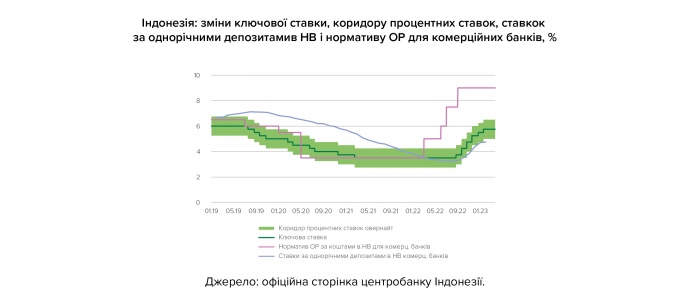

Some central banks went further and, in addition to increasing the OR standards, used additional tools. An interesting example is the Central Bank of Indonesia. The level of inflation in Indonesia was not too high compared to other countries – price growth at its peak in September reached 5.95%.

At the same time, the local Central Bank was aware of the challenges generated by the strengthening of monetary policy in developed countries. So in the beginning the bank moved to liquidity normalization policy.

The rate of interest rate in the national currency was gradually increased from 3.5% to 9% – a historical maximum. Such steps in six months made it possible to “connect” about 22% of banks’ liquidity.

Additionally, the Central Bank of Indonesia sold government bonds from its portfolio on the secondary market, and in addition – issued its own debt instruments with terms from 1 to 12 months. Having absorbed the liquidity, the Central Bank in August began a cycle of interest rate policy tightening and gradually increased the key rate from 3.5% to 5.75%.

The experience of Hungary is also interesting. The steady increase in inflationary pressure forced the Central Bank of this country to return to active interest policy: the key rate was raised to 13% from the ultra-low level of 0.6%.

In 2021, the Central Bank of Hungary introduced a new instrument – one-month discount bills. Initially, they were issued on an irregular basis, but in October 2022 the Central Bank made these operations regular in view of the further acceleration of inflation (above 20%).

In addition, banks were given the opportunity to place liquidity on deposits with the Central Bank for up to 6 months. Thus, in December 2022, the Central Bank absorbed from the banking system with the help of one-month discount bills about 13% liquidityand more about 20% sterilized through six-month deposits.

But the Central Bank of Hungary did not stop there. In October, he launched overnight deposit tenders at a rate of 18%. It was assumed that at this rate, banks would place for the overnight term liquidity, which exceeds the volumes of the ORs formed by them.

In December, based on average daily balances, such deposit tenders were “tied” about 40% of bank liquidity. These operations have become the main instrument of the monetary policy of the Central Bank of Hungary, and the rate behind them is de facto key. Given that the de jure key rate remained at 13%, there was a significant tightening of monetary policy.

In addition, since October, the Central Bank has sharply increased the OR standard from 1% to 5-10%: banks Optional could independently choose a reserve rate of 5% to 10% per quarter. This helped the Central Bank to absorb more in December about 25% of the liquidity of the banking system.

Such changes supported the transmission of monetary policy.

In 2023, the Central Bank of Hungary continued experiment from OR. In January, he announced an increase in the OR standard by another 5 cents. p. In February, it was decided not to charge interest on 25% of the formed reserves, instead, on 75% of the volume, to charge interest in the amount of the key rate (13%). The rate of overnight deposit tenders (18%) will be charged on additional reserves formed above the standard of 10%.

Ukraine: wartime monetary policy

In March 2021, the National Bank, one of the first among the world’s central banks, began to raise the key rate in response to the expected acceleration of inflation. This made it possible to reverse the inflationary trend (in most countries it was only gaining momentum) and end the year with inflation at the level of 10%.

In order to ensure a steady decrease in inflation, it was necessary to strengthen the effectiveness of the interest rate channel of monetary transmission. Accordingly, at the end of January 2022, the NBU announcedwhich in February will increase the OR standards for current accounts in national and foreign currencies.

However, after the full-scale invasion of the Russian Federation in order to maintain the liquidity of Ukrainian banks (so that even with the realization of risks, they would continue to properly fulfill their obligations to clients), the NBU reversed the decision on raising the norms of OR.

The war led to destruction, losses and disparities, which led to another reversal of the inflationary trend – now in the direction of growth. When the uncertainty decreased and Ukrainians began to return to the economic logic of decision-making, and the demand for currency increased, the NBU increased the discount rate.

This decision aimed to solve several problems: to reduce the demand for currency, to increase the stability of the foreign exchange market, to enable citizens to protect their savings against inflation, and ultimately to contain inflation.

Like most countries, Ukraine has faced the challenges of a structural liquidity surplus since mid-2022, which is expected to have arisen against the background of the government’s conversion of foreign currency received from international partners. The second source of the surplus is emission financing of the budget deficit by the NBU to ensure military needs.

As a result, these funds settled in the current accounts of Ukrainians in banks, given that the hryvnia interest rates on term deposits were still not attractive enough for depositors. This created risks for macro-financial stability. Realizing that the level of liquidity will continue to be high due to significant budget expenditures, the NBU implemented measures to optimize the structural surplus of liquidity.

IN In December, the NBU increased by 5 cents. p. standards of the OR on demand and current accounts in national and foreign currencies. And in order to avoid emission financing of the budget deficit in 2023, the NBU allowed banks to form up to 50% of the OR at the expense of the benchmark OVDP. Later NBU additionally increased the standards of the OP in two stages.

In general, as a result of three increases in the OR standards, the total amount of reserves formed by banks increased by more than UAH 210 billion (about 40% of the liquidity of the banking system as of March 21). And thanks to the mechanism for covering the OR of the benchmark OVDP in the incomplete three months of 2023, the government attracted about UAH 90 billion from the placement of hryvnia OVDP. For comparison, the amount of hryvnia government bonds raised by the government in 2022 totaled UAH 164 billion.

Recently, the National Bank of Ukraine further specified the mechanism of calculation of OR – from May 11, 2023, the lower standards for the formation of OR by banks based on time funds on household accounts in national (0%) and foreign currencies (10%) will apply only to deposits with an initial term of three months or more. This will make it difficult to manipulate ultra-short deposits to bypass the strengthened regulations of the OP and preserve the effectiveness of this monetary instrument.

In addition, from April 7, 2023, the operational design of monetary policy will be updated by simultaneously:

- Introduction of a new three-month deposit certificate at a fixed rate at the accounting level (25%). The amount of money that banks will be able to invest in such certificates will be determined by the amount of the existing portfolio of household hryvnia deposits of three months or more and the subsequent attraction of such deposits by banks.

- Rate reduction for overnight deposit certificates up to 20%.

These measures should invigorate competition for depositors, because only those banks that have actively attracted and will continue to attract hryvnia deposits from citizens with a term of three months or more will receive better returns on certificates.

At the same time, monetary conditions will not undergo significant changes, because together with the growth of portfolios of term hryvnia deposits of the population, the volumes of bank operations with new certificates at the discount rate will gradually increase. This will balance the effect of the rate reduction for overnight certificates.

The measures of the NBU are yielding results. Consumer inflation is decreasing faster than expected, inflation and exchange rate expectations have improved, the balance of the foreign exchange market has increased, and the volume of international reserves is sufficient to maintain exchange rate stability in the future.

In recent months, the growth of deposit rates has accelerated. Banks that most actively raised rates in recent months were able to improve their positions on the deposit market.

Further growth of time deposits of the population will reduce the risks to currency and exchange rate stability and contribute to the reduction of inflation. This will make it possible in the long run to ease currency restrictions, which will help the economy to return to sustainable economic growth.

Authors: Mykhailo Rebrik, Head of the Monetary Policy Department of the Department of Monetary Policy and Economic Analysis of the NBU

Plachinda Victoria, Chief Economist of the Monetary Policy Department of the Department of Monetary Policy and Economic Analysis of the NBU

Vitaly the shopkeeperleading economist of the Monetary Policy Department of the Department of Monetary Policy and Economic Analysis of the NBU

A column is a type of material that reflects exclusively the point of view of the author. It does not claim objectivity and comprehensive coverage of the topic in question. The point of view of the editors of “Economic Pravda” and “Ukrainian Pravda” may not coincide with the point of view of the author. The editors are not responsible for the accuracy and interpretation of the given information and perform exclusively the role of a carrier.

[ad_2]

Original Source Link