RoboForex analyst: Ukraine’s international reserves have grown again

[ad_1]

Gross international reserves of Ukraine at the beginning of this month amounted to 35.94 billion US dollars (relative growth compared to March — 12.69%). In April, the economy functioned without large-scale power outages, but this is not enough to start growth. Although Ukraine has resumed exporting electricity. Nevertheless, there are already predictions that blackouts will return in the summer, as the NPP units will be shut down for scheduled repairs.

A significant impact on the growth of our country’s international reserves was caused by the decrease in the volume of sales of foreign currencies by the NBU at the interbank level, including for the provision of defense needs and payments of Ukrainians abroad. At the same time, stable income from international partners allows us to continue to maintain financial reserves at a sufficient level, despite the ongoing hostilities. The current strengthening of the hryvnia relative to other foreign currencies is entirely due to the NBU and international partners. This was reported by Andrey Goilov, RoboForex analyst.

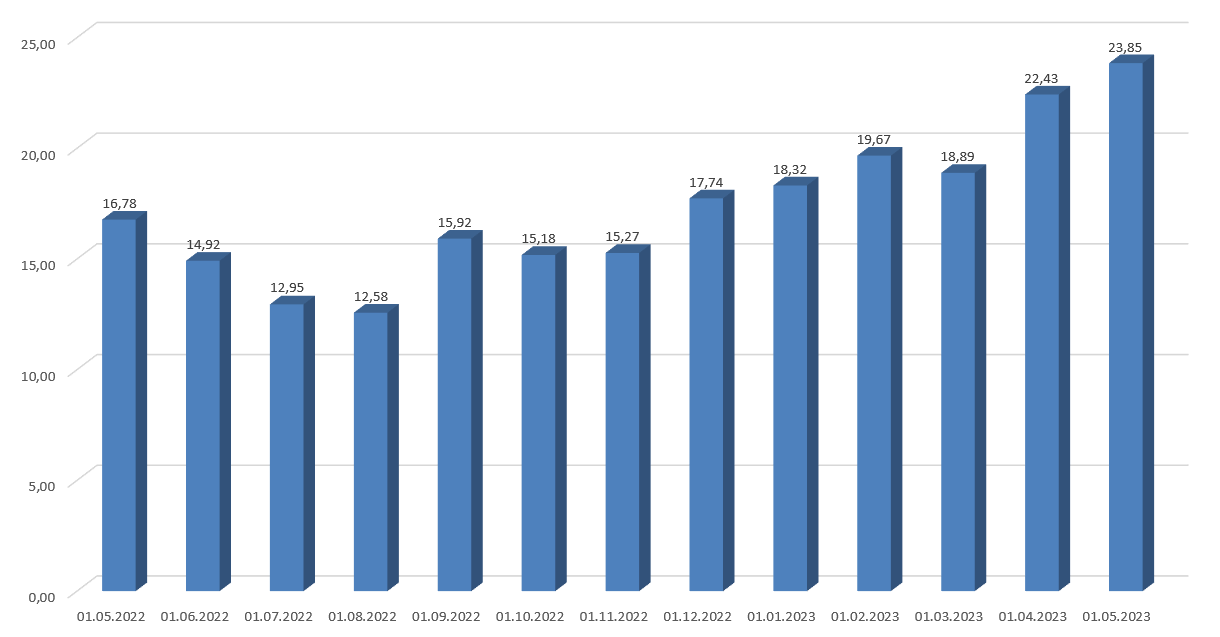

The chart below shows changes in this indicator over the last 13 months.

Gross international reserves of Ukraine 01.05.2022−01.05.2023 (billion US dollars). Source: NBU

From international partners, 5.85 billion US dollars came to the accounts of the Cabinet of Ministers from the IMF, the USA and the EU. 446.00 million dollars was sent to repay the external debt (including to the IMF). In April of this year, the negative balance of the National Bank’s active operations (the difference between the volume of currency purchases and sales) at the interbank amounted to 1.37 billion US dollars.

“Clean” international reserves of Ukraine 01.05.2022−01.05.2023 (billion US dollars). Source: NBU

“Clean” international reserves reached $23.85 billion — an increase of 6.33%. The accumulated amount provides financing for 4.7 months of planned imports, which is enough to fulfill the obligations of Ukraine, as well as to carry out current operations of the government and the National Bank. If the volume of monthly aid from international partners is maintained at the level of 4.00 billion US dollars, the hryvnia exchange rate will be stable and its smooth revaluation is even possible.

On the cash foreign exchange market, the hryvnia against the US dollar was fixed below the level of 37.90, and the euro reached the level of 40.80. Statistics show that the regulator spends very significant funds on maintaining the exchange rate of the Ukrainian national currency. Problems with the export of agricultural products only aggravate the situation, as the revenue in foreign currencies decreases.

Source: Ministry of Finance

Views: 13

[ad_2]

Original Source Link