Currency forecast: the Fed has raised the discount rate and does not intend to stop

[ad_1]

The US Federal Reserve increased the interest rate by 0.25% to 5.25% per annum. The head of the Federal Reserve, Jerome Powell, said that the regulator will strive to reduce inflation to 2%. Problems in the banking system are not of a critical nature. At the same time, the leadership of the Fed did not announce a “pause” in the cycle of increasing the discount rate – the regulator “keeps the intrigue”. Powell also noted the importance of a timely decision to raise the “ceiling” of the US national debt for the stability of the financial system. This was reported by RoboForex analyst Andrei Goilov.

Chart of the currency pair EURUSD, D1.

In the EURUSD pair, support was formed at 1.0833 and resistance at 1.1069. The dollar may weaken to the level of 1.1115. At the same time, for the further growth of EUR, the quotations must return to the level of 1.0974. If the US dollar strengthens below the level of 1.0974, it can strengthen to 1.0755. However, so far the most likely scenario is with ego weakening.

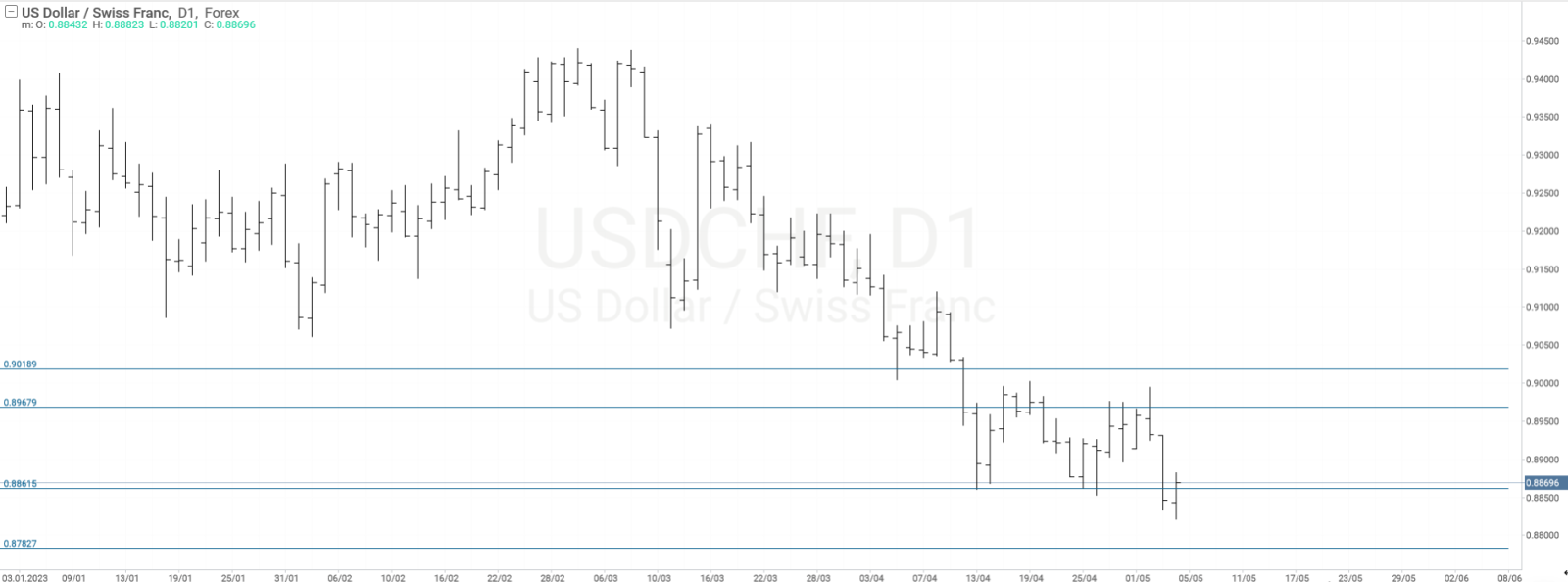

Chart of currency pair USDCHF, D1.

Chart of currency pair USDCHF, D1.

In the USDCHF currency pair, the resistance level has now moved to 0.8967, and support has not yet been formed. If the price is fixed below 0.8861, the dollar will weaken to the level of 0.8775. Otherwise, it may strengthen to 0.9018.

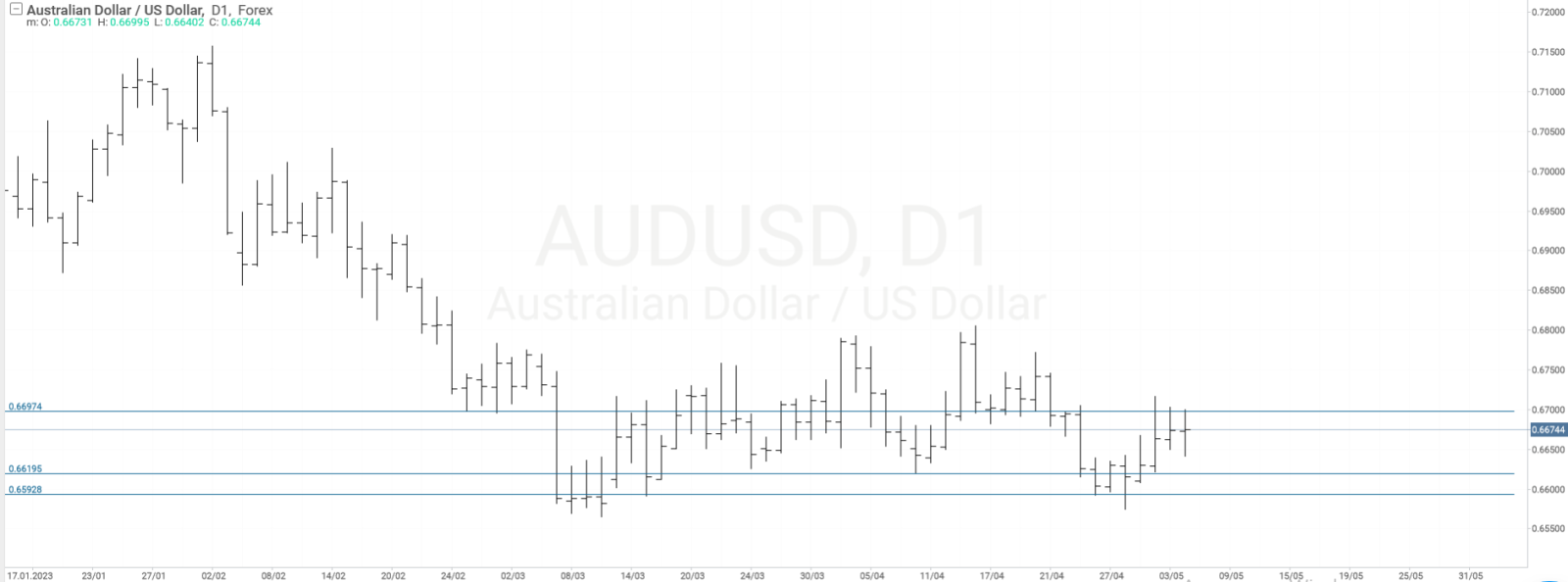

Chart of currency pair AUDUSD, D1.

Chart of currency pair AUDUSD, D1.

In the AUDUSD currency pair, resistance is formed at 0.6697, and support is at 0.6592. It is possible that the US dollar will strengthen to 0.6435. A signal for its weakening may be the anchoring of quotations below the level of 0.6619.

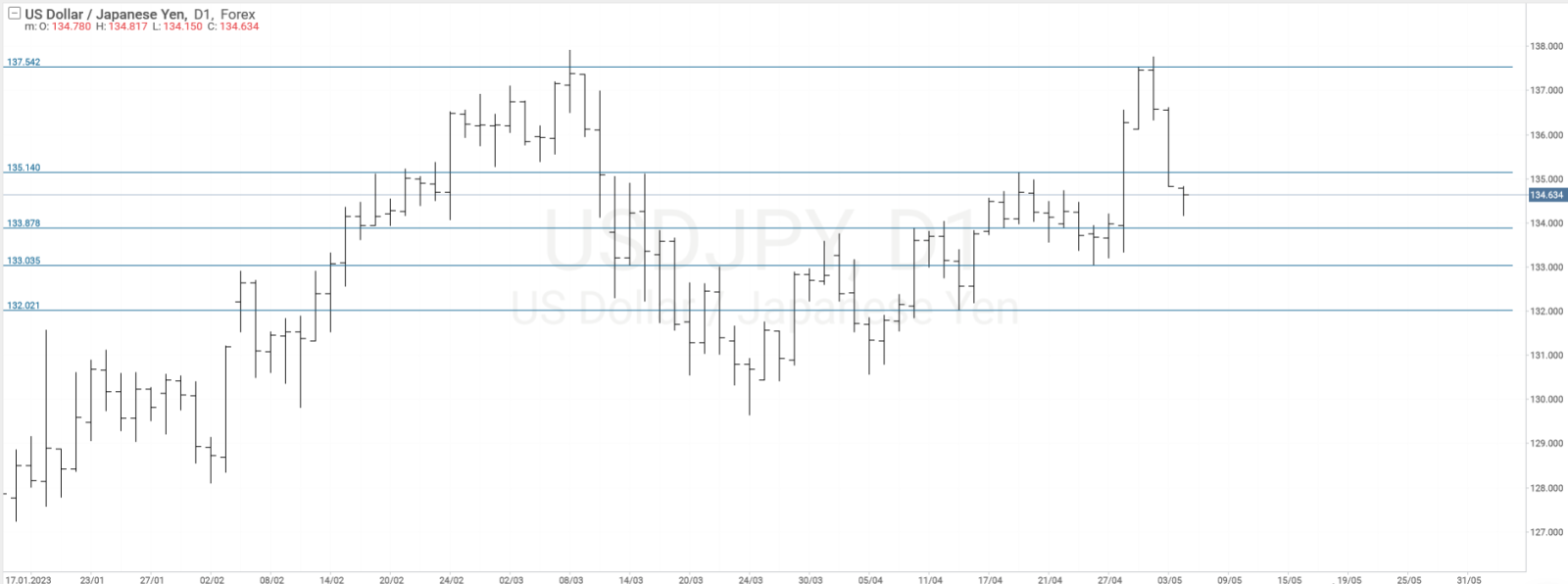

Chart of currency pair USDJPY, D1.

Chart of currency pair USDJPY, D1.

In the currency pair USDJPY, the resistance levels at 137.54 and support at 133.03 were indicated. At the moment, the USD is striving to reach record highs since the beginning of this year. For this, he needs to overcome resistance and gain a foothold over it.

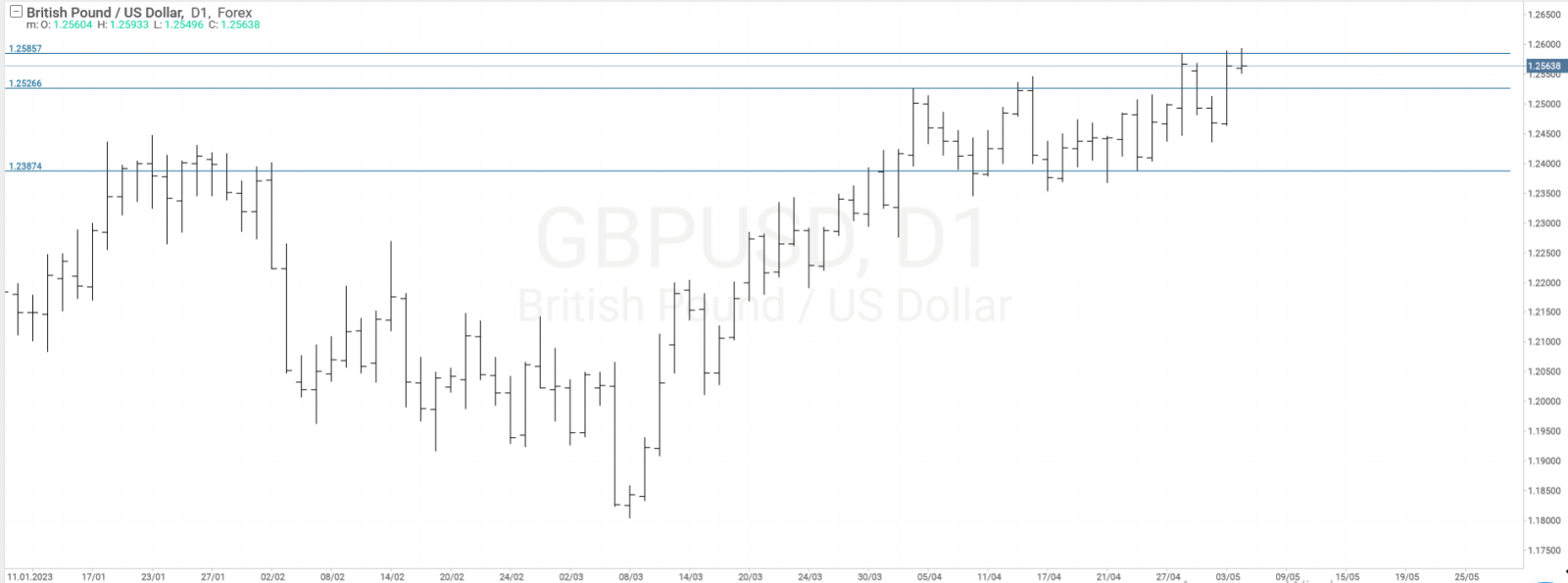

Chart of currency pair GBPUSD, D1.

Chart of currency pair GBPUSD, D1.

In the currency pair GBPUSD, support was formed at the level of 1.2387, and resistance at 1.2585. When the resistance level is broken, the pound will be able to reach the level of 1.2642.

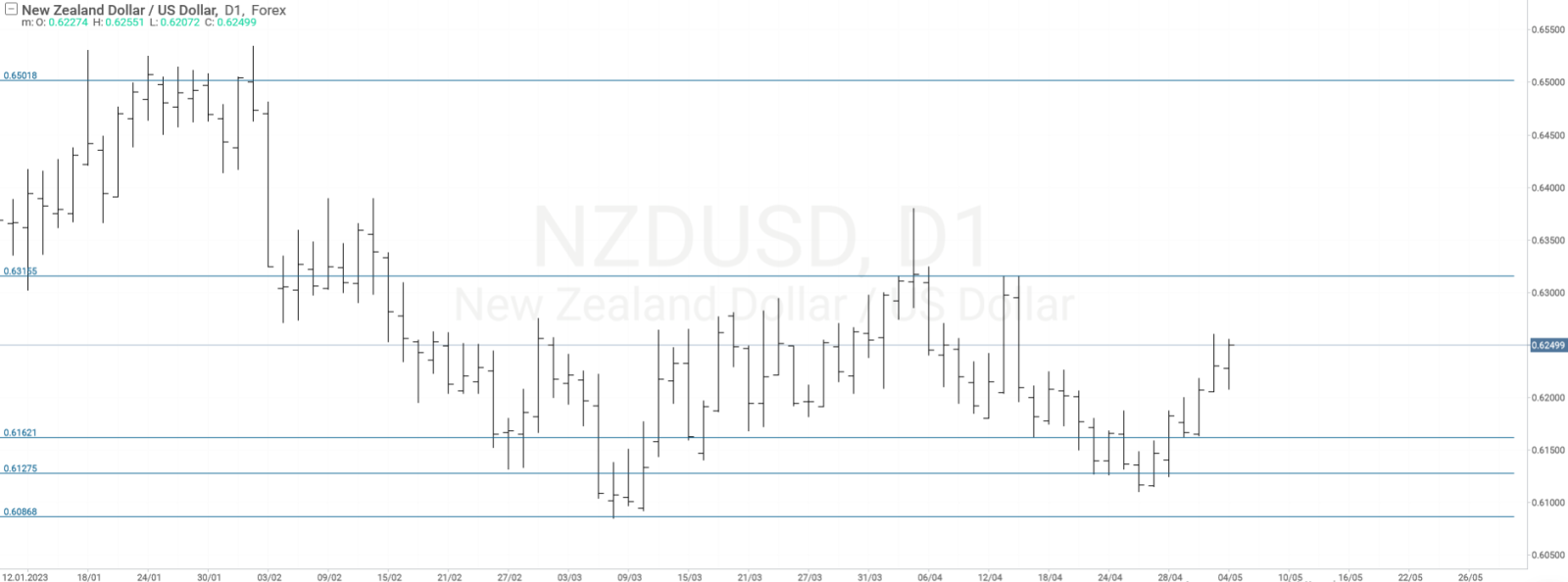

Chart of currency pair NZDUSD, D1.

Chart of currency pair NZDUSD, D1.

A support level of 0.6162 was formed in the NZDUSD currency pair. Resistance has not yet been formed at the time of writing the comment. In the current situation, the US dollar may weaken to 0.6315.

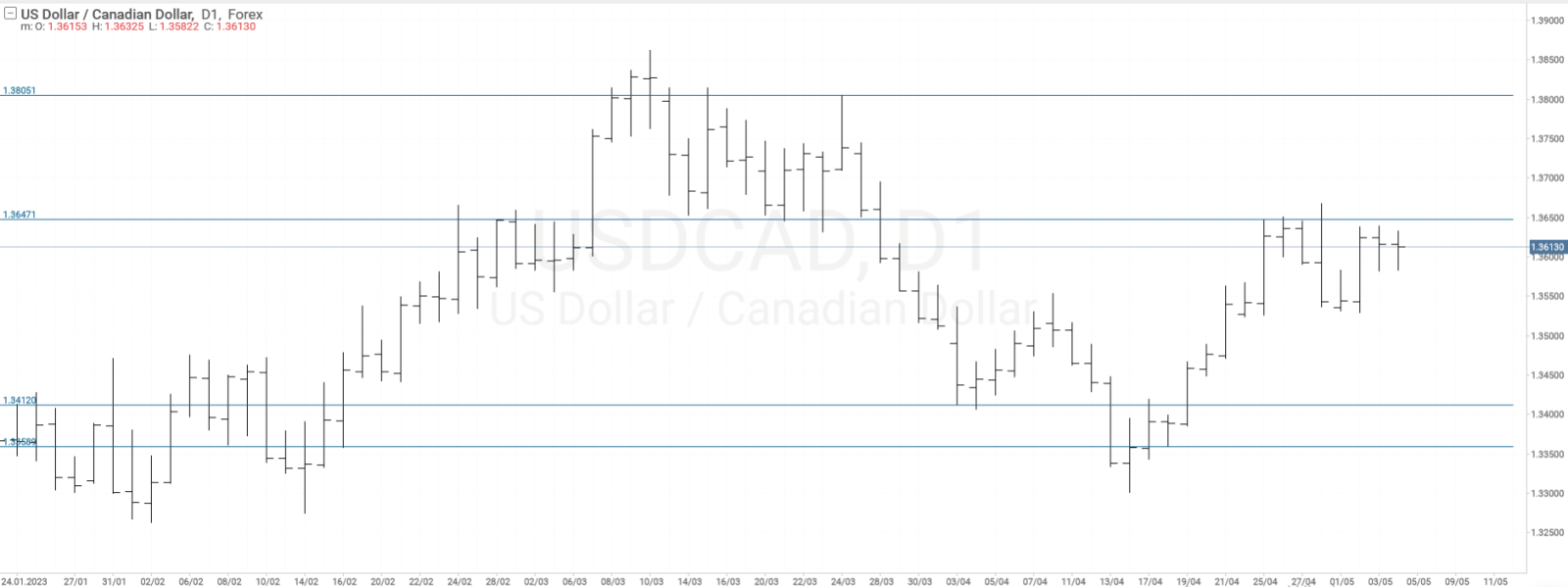

Chart of currency pair USDCAD, D1.

Chart of currency pair USDCAD, D1.

In the USDCAD currency pair, a support level appeared at 1.3358. Resistance is now at 1.3647. The Canadian dollar weakened against the backdrop of lower oil prices. If the resistance is broken, the USD will strengthen to 1.3805.

Source: Ministry of Finance

Views: 12

[ad_2]

Original Source Link