RoboForex analyst: NBU spent more than 3 billion US dollars from reserves

The NBU published a report on the results of its activities on the foreign exchange market. In January of this year, the negative balance of the National Bank’s active operations (the difference between the volume of currency purchases and sales) at the interbank level amounted to 3.08 billion US dollars. These funds, in fact, ensured the stability of the hryvnia last month. Together with the NBU’s complex of measures to combat speculators, this led to the strengthening of the Ukrainian national currency. Since the beginning of the military conflict, the regulator has sold more than 26.00 billion US dollars at the interbank. It should be noted that it functions in a special mode and commercial banks trade directly with the regulator, and exporters are in no hurry to enter the market by selling foreign currencies. Perhaps the recent strengthening of the euro will change the current state of affairs. This was reported by Andrey Goilov, RoboForex analyst.

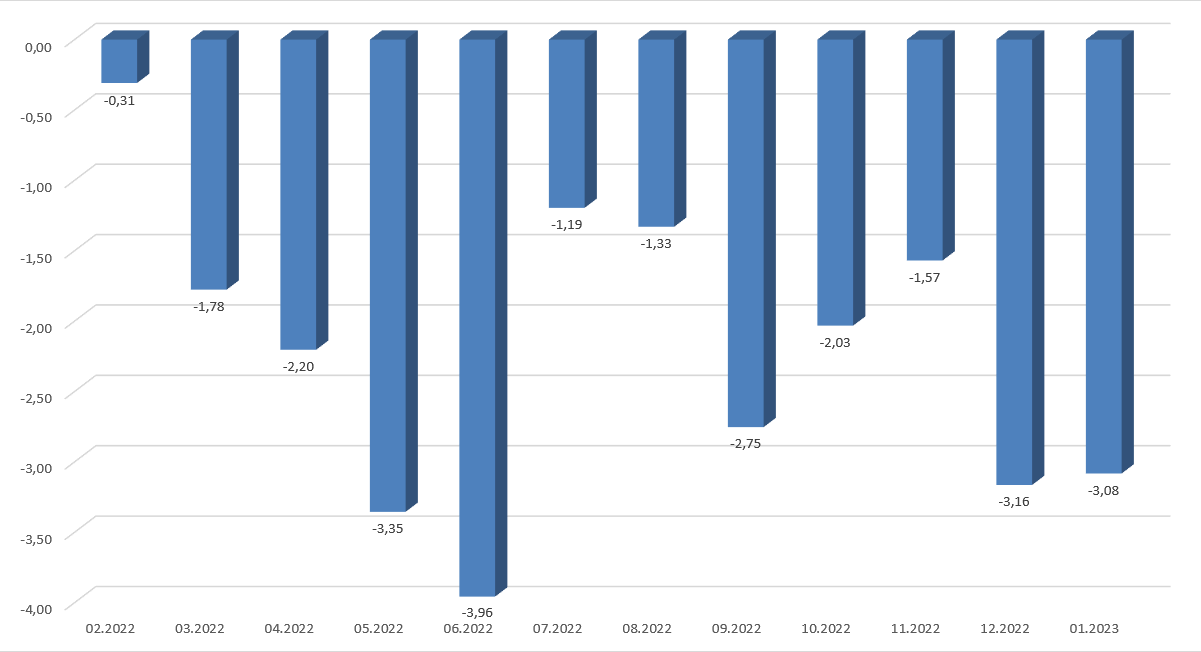

The balance of transactions of natural persons for the purchase and sale of foreign currencies 02.2022−01.2023 (billions of US dollars). Source: NBU

It can be seen from the presented diagram that in the last 2 months there has been an increase in demand for foreign currencies relative to November 2022. This indicator has been increasing since the beginning of hostilities between Russia and Ukraine. The regulator strove to ensure the stability of the hryvnia exchange rate and prevent its rapid devaluation, as happened in 2015. On the cash market, the euro and the US dollar continue to depreciate slightly relative to the Ukrainian national currency. The turnover of the interbank foreign exchange market decreased by 5 times, as there is a large-scale drop in business activity. The NBU is trying to resume interbank trading, but it will be extremely difficult to do so without the return of business to full-fledged work. The result of all these factors was the devaluation of the hryvnia against the euro.

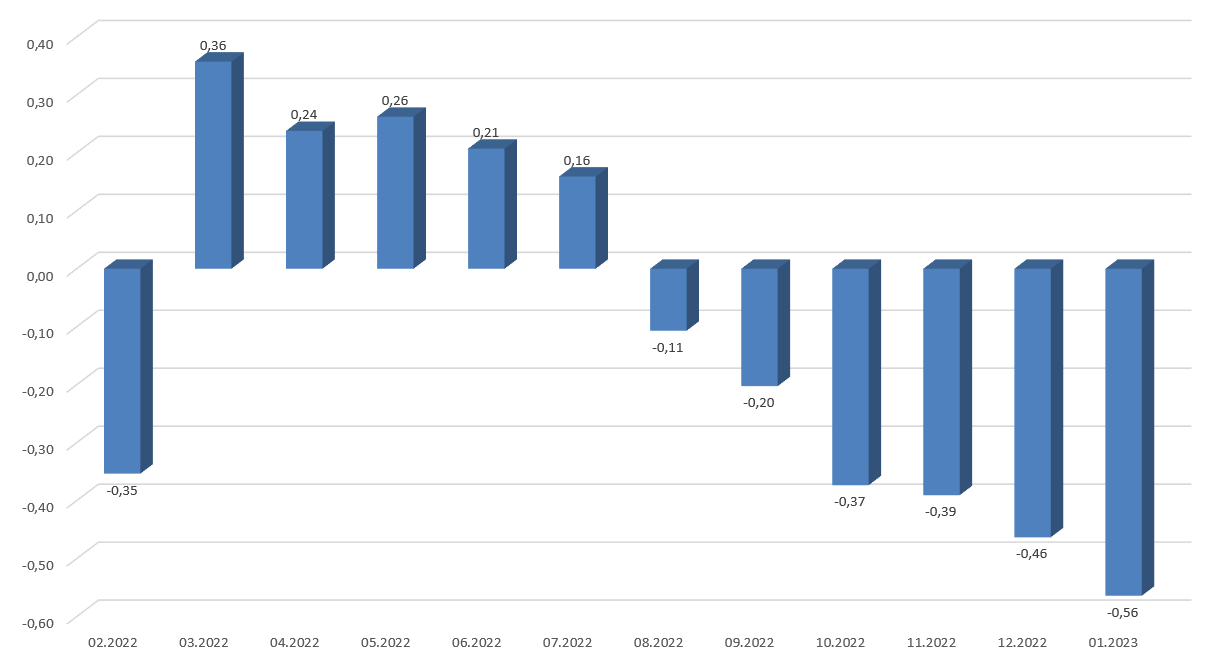

The balance of transactions of natural persons for the purchase and sale of foreign currencies 02.2022−01.2023 (billions of US dollars). Source: NBU

The graph shows that the population bought more foreign currencies than before. Ukrainian citizens who fear further weakening of the hryvnia bought 560 million US dollars. Such activity of individuals has not been observed since February last year. The population uses the current stabilization of the hryvnia exchange rate to replenish their savings. Many people understand that after the end of hostilities, support from international partners will decrease. Because of this, the NBU will be forced to weaken the rate of the Ukrainian national currency. Some citizens sell the hryvnia before emigrating to the EU and other countries after the attacks on the energy infrastructure of Ukraine.

On the cash foreign exchange market, the hryvnia against the US dollar was fixed below the level of 40.50, and the euro reached the level of 42.50. Further strengthening of the hryvnia in the medium term is unlikely. Problems in the energy industry will lead to a reduction in the volume of own production and an increase in demand for imported goods. The latter will put pressure on the hryvnia.

- NBU

- USA

- Dollar

Source: Ministry of Finance

Views: 10